Recent data from Poland shows that central banks' low-interest rate policy leads to excessive cash withdrawals. Low rates are counterproductive in fighting cash. So prepare for CBDCs!

An interesting observation from Poland on how low interest rates set by central banks can lead to excessive withdrawing of cash from banks.

Firstly, when interest rates are low, the returns on savings accounts and fixed deposits diminish, making them less attractive to savers. People perceive that their money is non-productive in banks, leading to a preference for either spending it or investing it in higher-yielding alternatives outside the banking system, such as stocks, real estate, or other vehicles.

In extreme cases of negative interest rates (rates below zero as it happened a few years ago), savers are prompted to withdraw cash to avoid paying fees on their bank deposits.

As a consequence, one can expect that central banks will aggressively push towards CBDCs in the future. This will give them much more flexibility in setting interest rates while not loosing control on cash. So another reason why they hate cash.

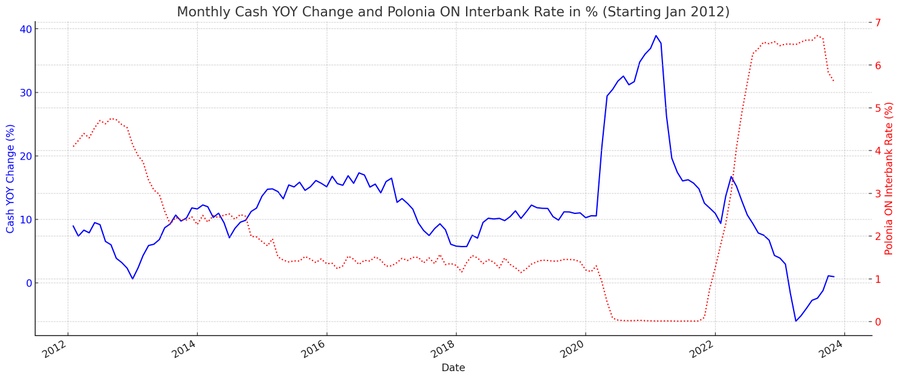

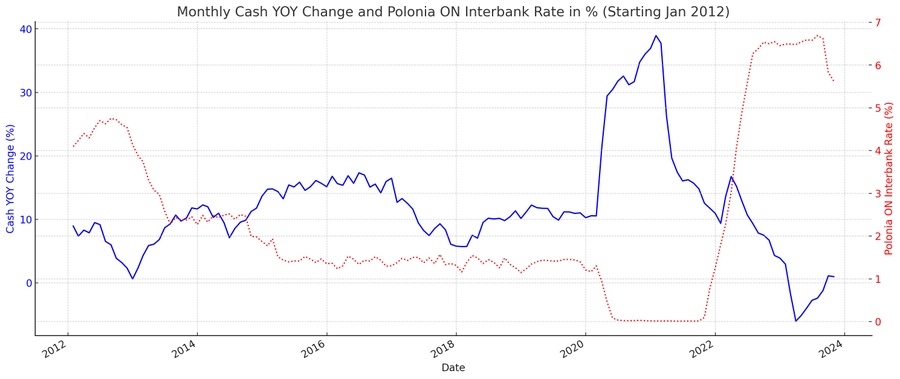

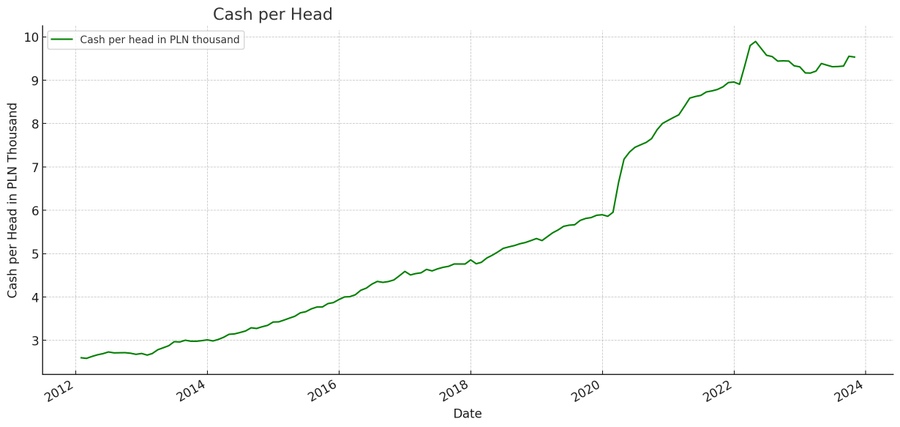

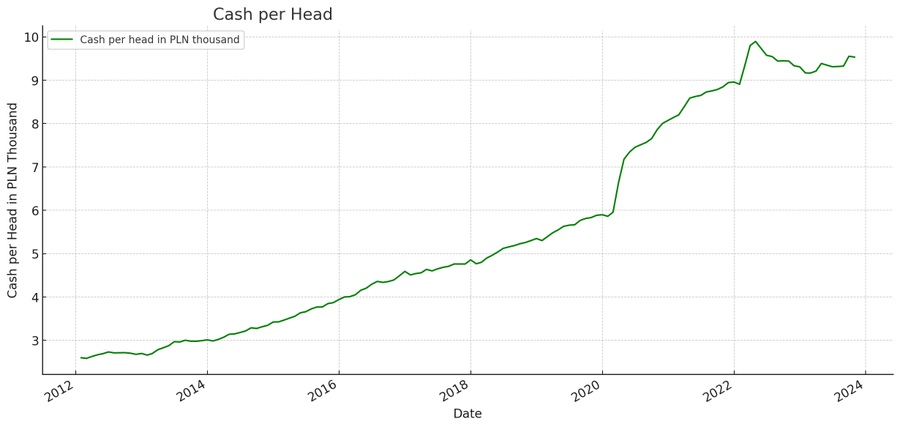

Attached charts show perfect inverse correlation of market interest rates and the growth of cash in circulation. Surely, there might be some extraordinary events (pandemics or war in UA) which have significantly amplified the trends but anyway I assume the trends are clear.

An interesting observation from Poland on how low interest rates set by central banks can lead to excessive withdrawing of cash from banks.

Firstly, when interest rates are low, the returns on savings accounts and fixed deposits diminish, making them less attractive to savers. People perceive that their money is non-productive in banks, leading to a preference for either spending it or investing it in higher-yielding alternatives outside the banking system, such as stocks, real estate, or other vehicles.

In extreme cases of negative interest rates (rates below zero as it happened a few years ago), savers are prompted to withdraw cash to avoid paying fees on their bank deposits.

As a consequence, one can expect that central banks will aggressively push towards CBDCs in the future. This will give them much more flexibility in setting interest rates while not loosing control on cash. So another reason why they hate cash.

Attached charts show perfect inverse correlation of market interest rates and the growth of cash in circulation. Surely, there might be some extraordinary events (pandemics or war in UA) which have significantly amplified the trends but anyway I assume the trends are clear.

7 users upvote it!

3 answers